florida inheritance tax amount

Taxable Dollar Amount Total Tax Owed. Ad Look For Florida Inheritance Tax Now.

Is There An Inheritance Tax In Texas

The heirs and beneficiaries inherit the property free of tax.

. Inheritance Tax in Florida. However Florida residents may have to pay inheritance taxes if they have properties in some states. Florida does not impose an inheritance tax on residents.

Learn more today from our experienced attorneys. Several states charge inheritance taxes on a deceased persons estate. Taxing Inheritance as Income in Florida.

Spouses in Florida Inheritance Law. Select Popular Legal Forms Packages of Any Category. Inheritance Tax Caveats to Be Aware Of.

0 percent on transfers to a surviving spouse or to a parent from a child aged 21 or younger. Inheritance Tax in Florida. The federal estate tax only applies if the value of the estate exceeds 114 million 2019 and the tax thats incurred is paid out of the estatetrust rather than by the beneficiaries.

There is no federal inheritance tax but there is a federal estate tax. Ad Over 27000 video lessons and other resources youre guaranteed to find what you need. As mentioned above the State of Florida doesnt have a death tax but qualifying Florida estates are still responsible for the federal estate tax there is no federal inheritance tax.

The federal government however imposes an estate tax that applies to residents of all states. Inheritance tax doesnt exist in Florida at any level. The State of Florida does not have an inheritance tax or an estate tax.

Furthermore since the inherited property is not considered income for federal income tax purposes inheritors and recipients in Florida dont pay income taxes on any funds earned from an inheritance. All Major Categories Covered. The tax rate varies depending on the relationship of the heir to the decedent.

Even though Florida doesnt have an estate tax you might still owe the federal estate tax which kicks in at 117 million for 2021. To the extent its assets exceed the 1118 million exemption as of 2018 an estate is taxed at a marginal rate of up to 40. Even further heirs and beneficiaries in Florida do not pay income tax on any monies received from an estate because inherited property does not count as income for Federal income tax purposes and Florida does not have a separate income tax.

No Florida estate tax is due for decedents who died on or after January 1 2005. The excellent news is that there are no state inheritance taxes in Florida. If someone dies and leaves behind a spouse who they were legally married to at the time of death the spouse is first in line to inherit everything.

This means if your mom leaves you 400000 you get 400000 there are no taxes to pay. If the married. According to Florida inheritance laws the surviving spouse will receive 100 of the estate if there are no surviving children or if the only surviving children belong to the surviving spouse and the deceased.

Trusts and Estate Tax Rates of 2022. However an estate tax that applies to citizens of all states is levied by the federal government. In 2022 an individual can leave 1206 million to their heirs without paying any federal estate or gift tax.

Also known as estate tax or death tax the inheritance tax is the legal rate at which a state taxes the estate of someone who died owning property. The Federal government imposes an estate tax which begins at a whopping 40this would wipe out much of the inheritance. The federal estate tax applies only if the value of the whole estate reaches 117 million 2021 and the tax borne is paid not by the beneficiaries but by the estatetrust.

Most assets devised through a will inheritance process will not result in tax liability. If there were no children either from the couple or from the deceaseds previous relationship then the surviving spouse is the sole heir. Its against the Florida constitution to assess taxes on inheritance no matter how much its worth.

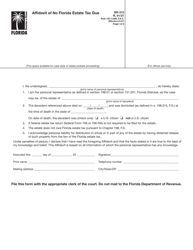

Additionally the new higher exemption means that theres room for them to give away another 720000 in 2022. If the estate is not required to file Internal Revenue Service IRS Form 706 or Form 706-NA the personal representative may need to file the Affidavit of No Florida Estate Tax Due Florida Form DR-312 to release the Florida estate tax lien. Inheritance tax is imposed as a percentage of the value of a decedents estate transferred to beneficiaries by will heirs by intestacy and transferees by operation of law.

There isnt a limit on the amount you can receive either any money you receive as an inheritance is tax-free at the. One thing to be aware of is that while Florida does not have an inheritance tax there is still a federally imposed inheritance tax. Florida does not have a separate inheritance death tax.

Some states also impose gift taxes on inheritance butyou guessed itFlorida does not have a gift tax either. Yet some estates may have to pay a federal estate tax. The lowest tax rate applying to excess amounts of 1 10000 is 18 while the maximum tax rate applying to excess amounts of 1 million or more is 40.

In 2022 federal estate tax generally applies to assets over 1206 million and the estate tax rate ranges from 18 to 40. Federal Estate Tax. Common examples include money market accounts IRAs and 401Ks.

There are exemptions before the 40 rate kicks in and an attorney can provide advice on setting up your estate to minimize taxes. Delivering Top Results from Across the Web. 18 of the taxable amount.

Fortunately the inheritance tax rate in Florida is zero. The federal inheritance tax however only applies to inheritances over 117 million. Married couples can avoid taxes as long as the estate is valued at under 2412 million.

The only other way that inheritance can result in taxation in Florida is when it counts as income. What this means is that estates worth less than 117 million wont pay any federal estate taxes at all. Florida residents are fortunate in that Florida does not impose an estate tax or an inheritance tax.

Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. There are no inheritance taxes or estate taxes under Florida law. While there are fees and expenses associated with the probate process in Florida the state has no inheritance tax.

1800 20 of anything over 10000. But if the surviving children were from a previous spouse then the surviving spouse will receive 50 of the estate and the other. Understanding Inheritance Tax in Florida is essential to properly plan your estate.

If you die in Florida with less than the exemption amount you will not owe any federal estate tax. This applies to the. Florida Inheritance Tax Law.

This is the Newest Place to Search. The federal inheritance tax is graduated meaning that the larger the amount of money in excess of 117 million the higher the rate at which it is taxed. The good news is Florida does not have a separate state inheritance tax.

/estate_taxes_who_pays_what_and_how_much-5bfc342146e0fb00265d85b5.jpg)

Estate Taxes Who Pays And How Much

Eight Things You Need To Know About The Death Tax Before You Die

Inheritance Laws In Florida Explained

Federal Estate Tax Facts You Should Know So You Can Pass As Much Tax Free Money As Possible To Loved Ones Karp Law Firm

Form Dr 312 Download Printable Pdf Or Fill Online Affidavit Of No Florida Estate Tax Due Florida Templateroller

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Florida Attorney For Federal Estate Taxes Karp Law Firm

Does Florida Have An Inheritance Tax Alper Law

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

What S In A Name Part 2 Tax And Other Consequences Caused By Joint Ownership Of Real Property Sgr Law

Does Florida Have An Inheritance Tax Alper Law

New York S Death Tax The Case For Killing It Empire Center For Public Policy

Restoring The Federal Estate Tax Is A Proven Way To Raise Revenue And Address Wealth Inequality Equitable Growth

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Florida Estate Tax Rules On Estate Inheritance Taxes

Where Not To Die In 2022 The Greediest Death Tax States

Florida Estate And Inheritance Taxes Estate Planning Attorney Gibbs Law Fort Myers Fl